Introduction

Ireland’s economic crisis and the central problems in the housing system that played a large part in precipitating that crisis should make it clear that there is an urgent need for new ways of thinking about housing. The model that became dominant during the economic boom was one of market idolatry and the relentless commodification of housing, such that it became primarily an investment vehicle for realising exchange values, often from no productive activity whatsoever.

Michael Punch

This value system meant that the more meaningful use value of housing as a home, a response to a basic human need, and a central element in community and societal development was typically secondary, if not lost altogether. Concern about housing commodification has been voiced by commentators for many years, but it is perhaps only with the current crisis that it has gained wide recognition, and indeed the Irish Government has also come at last to this conclusion in its Housing Policy Statement, issued in June 2011.1

This article first analyses the most recent evidence regarding housing needs and vulnerability. It then examines the process of realignment of social housing towards greater dependence on market mechanisms, a central policy trend of recent years that may deepen rather than lessen the divisions in Irish housing.

Housing Vulnerability Now

Household Indebtedness

Within the model adopted in Ireland over the boom–bust years, the disconnection between the housing market and the real world is immediately evident from the trend in house prices over the long run, when compared to the trend in actual building costs. In the period 1975 to 1995, the price of newly-built housing and the costs of house production (in terms of materials and labour) ran in parallel. But from 1995 onwards there was a sudden rise in house prices, which was unrelated to real building costs. This divergence between costs and selling price continued and indeed escalated sharply right until the end of the housing boom. Overall, between 1994 and 2007, ‘while building costs rose by 82 per cent, the price of new housing rose by more than four times as much’.2

In some respects, the current downturn suggests a correction that, perhaps, still has a way to go. More importantly, the reality that the over-valuation of Irish housing was financed via irresponsible lending on both supply and demand sides (the act of financial institutions which, motivated by greed, betrayed the common good) has left many households in a position of vulnerability.

The core issue here is not so much negative equity (a psychological shock for some, but arguably not a problem in the long term) but unsustainable mortgages in the face of job losses, the politics of austerity and uncertain interest rates. Indebtedness is a large burden for many households – nationally, household debt was €128 billion in September 2011 or about 82 per cent of GDP. Most of this was mortgage debt – €98 billion. At the end of the third quarter of 2011, 16,599 households were in mortgage arrears for 91–180 days, while 46,371 were in arrears for more than 180 days. At this time, 884 properties were being repossessed.3

Housing Need

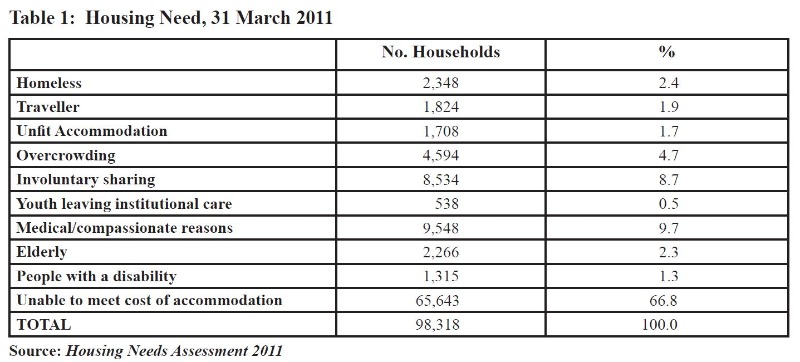

Recent trends in unmet housing need reveal something of the struggles and crises facing the most vulnerable households in Irish society on a daily basis. The official assessment of housing need in March 2011 revealed 98,318 households in need of social housing (the figure excludes those now accommodated under the Rental Accommodation Scheme (RAS)).4 This is an overall increase of 71 per cent since the economic downturn (56,249 households were assessed as being in need in 2008). However, the reality is that, for the most part, the boom period also was a time of rising numbers in housing need, with a 105 per cent increase between 1996 and 2008 (the only period where the numbers declined was 2002–2005).

By far the most prevalent cause of assessed housing need in 2011 is the unaffordability of current accommodation (accounting for 67 per cent of households on the waiting lists). In addition, a significant number of people are in need due to unsatisfactory housing conditions – in all, 15 per cent of the total households in need are included because of ‘unfit accommodation’, ‘overcrowding’ or ‘involuntary sharing’. Medical and compassionate reasons are the basis for housing need in almost 10 per cent of cases, while people who are homeless, Travellers, young people leaving institutions, people with disabilities, and elderly people make up the other categories of need (see Table 1).5

Single-person households make up half of the households registered as being in need, while families with children account for just over 44 per cent. Most are under 40 years of age (69 per cent). The needs figure includes 9,162 non-EU households (9.3 per cent of the total); these are people with refugee status, or who have been granted permission to remain in the State or given subsidiary protection status.

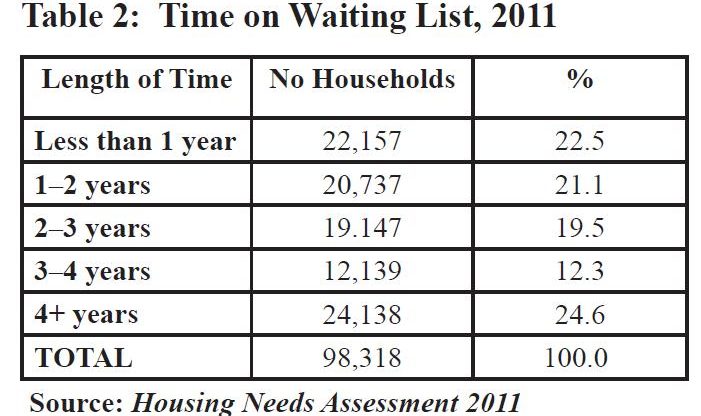

Incomes of households registered as in need of housing are very low – 27.5 per cent have an income less than €10,000, while 51 per cent are in the €10,000–€15,000 income bracket. Importantly, many of the households have spent considerable time on waiting lists – over one-third have been in need of social housing for over three years (see Table 2).

Housing Conditions

It should be noted that not everyone who currently has a social housing tenancy is adequately housed – many are enduring particularly harsh conditions. Notably, a number of estates targeted for regeneration (progress on which has been slow or non-existent) have been blighted by such plans.

The long-term process is one of initial neglect of an estate leading to problems of run-down, which is made worse through increasing vacancies as some residents understandably get out if they can. This dynamic of blight and decline becomes even more entrenched once local authorities ‘redline’ estates for regeneration and start to prioritise re-housing of tenants. In this manner, plans for regeneration by demolition instigate a very intense and rapid deterioration in conditions. There is little expenditure on maintenance; as residents move out, units become boarded up, causing further rundown. Tenants’ representatives have described the lived experience of planned obsolesence of this kind in terms of the degeneration of communities with costly long-term social consequences.6

Tenants have organised to document these experiences and to fight for basic housing rights. Powerful evidence has been collated by Community Action Network, Tenants First and the Rialto Rights in Action group, notably in its submission to the United Nations Independent Expert on Human Rights and Extreme Poverty, Magdalena Sepúlveda, in relation to her mission to Ireland in January 2011. This submission reported on the issues affecting residents of Dolphin House, such as ‘extremely poor and health hazardous conditions … including waste water invasions and damp’. More specifically, evidence from a door-to-door survey and scientific testing confirmed that everyday living conditions included ‘highly polluted waste water invasion through toilets, baths, sinks and washing machines, corrosive damp in bedrooms, kitchens and bathrooms, and mould containing pathogenic spores’. Other charges include the failure of the State to provide adequate opportunities for the participation of tenants in planning for regeneration. These living conditions and the general disempowerment of tenants violate the right to adequate housing as expressed in the United Nations’ International Covenant on Economic, Social and Cultural Rights.7

Homelessness

The most vulnerable population is surely those out of home. Evidence from those directly involved in homeless services suggests that the situation has worsened greatly.

More people are sleeping on the streets than at any time in the past decade, and typically people in need of emergency accommodation face long, wearying waits, often to be told there is nothing for them but a handout of a sleeping bag from the Council.8 In the experience of the voluntary group, Trust, which has been working with homeless people since 1975, the situation now is the worst it has ever seen.9 The current crisis should raise grave moral concerns in a society that holds to even a rudimentary sense of social justice and the right of people to live their lives with dignity and hope.

Margins of the Private Rental System

Many people in the private rental system are vulnerable to poor conditions and often unaffordable rents (notwithstanding some reduction in rental levels since the economic downturn). Those affected include people in low-income employment and a range of groups with social needs who are housed in this sector with State supports.

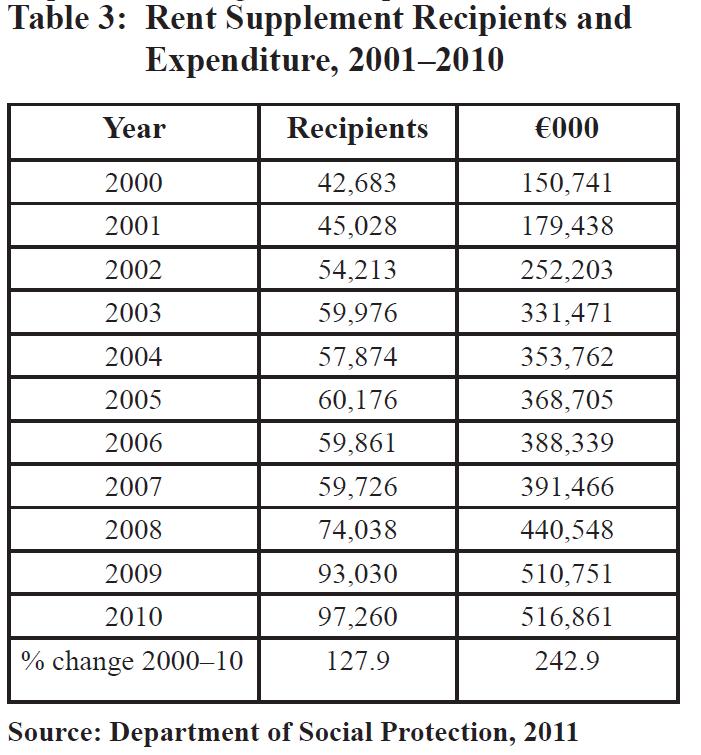

In 2010, there were 97,260 recipients of the Supplementary Welfare Allowance (SWA) rent supplement, an increase of 128 per cent over a decade in the numbers dependent on this scheme (Table 3).10 Over the same period, public expenditure on rent supplement increased 243 per cent to €517 million (Table 3).

People in their twenties and thirties made up the most prevalent age groups among those receiving rent supplement in 2010, representing almost half the total number of recipients. However, nearly 3 per cent were over 65, a significant minority. Almost half of all households receiving rent supplement in 2010 were long-term recipients (that is, longer than eighteen months); in other words, they fall into the target group for accommodation under the Rental Accommodation Scheme. In terms of economic status, the single largest category of people receiving rent supplement is made up of people dependent on Jobseeker’s Allowance: 39 per cent of short-term recipients and one third of long-term recipients were in this category. Lone parent families were another significant group, representing almost 12 per cent of short-term, and 21 per cent of long-term, recipients.

Although the SWA scheme provides an important, flexible, short-term solution to housing need or emergency (for example, for someone already in private rental accommodation who has just become unemployed), long-term dependency on this sector is a vulnerable place in which to find oneself. While the Residential Tenancies Act 2004 provided increased security of tenure, grounds are still available for landlords to evict (for example, where it is intended to use the property for family members’ needs or where refurbishment is planned). It may also be difficult to find a landlord willing to accept SWA tenants, or the available options may not match specific needs. More importantly, the quality of accommodation is variable and in many instances below minimum standards (in other words, illegal).

The scale of the problem of poor quality accommodation in the private rented sector is indicated in the findings of official inspections of such accommodation. In 2009, 18,000 private-rented dwellings were inspected nationally, of which 24 per cent were sub-standard, while 12.6 per cent had no rent book (also illegal). In Dublin City, 41 per cent of inspected properties were sub-standard, while in Limerick City the figure was 73 per cent.11

Low standards are a persistent feature of Ireland’s highly uneven private rented system, which is polarised between good-quality, higher-cost properties and marginal, low-quality flats and bedsits. For poorer households (for example, people out of work, in minimum-wage or low-wage jobs, or dependent on income supports) accepting such conditions or resorting to overcrowding are often their only options.

The problem of substandard accommodation is likely to be most pronounced in properties accessed by people dependent on rent supplements. Research by The Centre for Housing Research (2006) showed that, in eight case study areas, local authority inspections had found that 50 per cent of properties were below minimum standards. In Dublin City, 78 per cent were below the legal minimum, while almost no properties met the higher standards set by the RAS Unit.12 As well as the immediate justice issues involved, this is of wider concern since it means that public money is subventing illegal, unfit accommodation.

Part of the difficulty is that maximum rental limits imposed under the rent supplement scheme circumscribe choices in urban areas where need is greatest, leaving many people with no option but to seek low-quality accommodation. The single-person rent supplement cap in Dublin is €529 per month; however, in the second quarter of 2011, the average one-bed rents in the main rental areas ranged from €718 (Dublin 7) to €940 (Dublin 4).13 The cap for a family with one child is €930 per month. This would make an average one-bed apartment affordable, but the family would have to look at the lower end of the market for anything slightly larger (average two-bed rents in the main rental areas ranged from €943 to €1,259).

Housing Need … and Empty Houses?

It is worth noting one final stark contradiction in the state of the Irish housing system at this point in history. These various experiences of housing need and vulnerability are even more shocking when viewed against the opposite problem of vacant dwellings. The 2011 Census recorded 294,202 empty housing units nationally (almost 15 per cent of the total housing stock). By county, the lowest vacancy rate was in Kildare (8 per cent) while the highest was in Leitrim (30 per cent).

This is, of course, an astonishing picture of economic inefficiency and social and ecological injustice, not to mention a near total absence of spatial planning. While many of these empty houses are in rural locations (having been built around the Shannon and on the coasts, for example, as a result of tax breaks) and may not be suitable for the specific needs that exist, there are also large numbers of empty units in the cities. For instance, the 2011 Census showed that in the Dublin City Council area there were 26,000 empty housing units (10 per cent of the total housing stock).14 Meanwhile, 8,091 households in the city were experiencing unmet housing need.15

Deepening the Divide?

There is an important wider context that underpins at least some of the vulnerabilities apparent at the margins of the Irish housing system. The place and meaning of social housing has been substantially realigned over several decades and with considerable intensity in recent years. Historically, a range of voluntary organisations, philanthropic groups and the State provided housing for a significant proportion of Irish people. From the 1930s to the 1950s – times of great economic crisis for the State – the majority of new housing was provided by local authorities. The strong role of this sector continued to the 1970s.

Since then, its role has been reduced significantly, with greater emphasis on market provision and considerable energy given to the promotion of private ownership as an end in itself. Although social housing output as a proportion of all new housing has increased in recent years, this is partly a result of the calamitous fall in private output with the ending of the property bubble.

The overall stock of social housing is also affected by acquisitions (housing units purchased in the market for social use) and by sales to tenants at a discounted price. Allowing for these factors, the net annual addition to social housing averaged 3,440 units in the period 2000 to 2007. However, a further complicating factor of importance over the past decade or more was the de-tenanting and demolition of older units under various regeneration schemes. It is difficult to put a figure on the denuding of social housing through these processes of run-down but, as already noted, the human experience and social costs are considerable. The economic cost of the whole process – from the long run-down of such areas through to the direct costs of demolition and replacement – are also considerable. Funding announced in the public expenditure estimates for 2011 earmarked almost €205 million for regeneration.16

Market Mechanisms for Social Provision

While social provision dwindled, policy-makers turned more and more to market tools to respond to housing need, a preference confirmed in the official Housing Policy Statement, in June 2011. Dependence on the SWA rent supplement is a long-standing example of using the private rental sector as a way of meeting the State’s obligations in relation to social housing, while the RAS and long-term leasing solutions are more recent examples. There has also been a general shift in thinking on the part of many local authority members and officials, who in recent years have downplayed their responsibility as social landlords and promoted privatised solutions of this kind.

A number of regeneration policies also enshrined these principles, including Public Private Partnership proposals (most of which collapsed with the economic downturn) to demolish existing local authority flats complexes and replace them with denser developments of predominantly private housing (for investment or home ownership). Such privatisation plans have often been championed under the guise of ‘social mix’, when what is really being pursued is ‘tenure mix’ – two completely different concepts.17 The use of Part V of the Planning and Development Act as a means of leveraging social and affordable units from private property development projects was also market-driven.

The first transfers into the RAS from SWA rent allowance commenced at the end of 2005; by December 2010, 17,658 households had been housed directly under this scheme. RAS occupies an increasingly central place in central government policy. One of the ‘headline outputs’ in the Annual Report for 2010 of the Department of the Environment, Community and Local Government is a major restructuring of social housing investment away from construction/acquisition and towards ‘more flexible options, including RAS and the long term leasing initiative’.18 The budget for RAS in 2011 is €125 million, while €25 million was made available for long-term leasing.19 The total budget for social housing provision and support for 2011 is just short of €530 million.20 So the combined funding for RAS and leasing was 28 per cent of the overall budget for social housing provision.

How does leasing work? Dún Laoghaire-Rathdown County Council, for example, placed public advertisements inviting applications from property-owners interested in becoming leasehold landlords. Under the long-term lease agreement, the property owner signs up to a 10 to 20 year term during which rent is guaranteed, calculated at approximately 80 per cent of the open market rent, with four-year rent reviews as a norm. The property owner is responsible for the structural maintenance of the building but little else. The local authority is responsible for tenant management and rent collection. It is also responsible for maintenance. It is interesting that the local authority is willing to take on this responsibility, given that the cost of maintenance has often been cited as one of the reasons local authorities should move towards reducing their role in providing social housing.

The leasing arrangement provides several sources of cost-savings for the property owner in comparison to the market system: no rent loss during vacant periods, no letting fees, no rent arrears, no Non Principal Private Residency (NPPR) Charge or Private Rental Tenancy Board registration charge.

In the case of the RAS scheme, the term of the agreement is flexible and negotiated between the landlord and local authority. The rent is guaranteed at about 92 per cent of the open market rent with periodic rent reviews. Similarly, the landlord does not have to collect rent and does not lose out due to vacancy, rent arrears, letting fees, advertising or NPPR charges. However, the private landlord in this case is engaged in tenant management and property maintenance; in addition, the residence must be furnished.

The Voluntary and Co-operative Role

Government is also targeting the voluntary and co-operative sector to play a more central role in providing social housing. However, this is to occur not through direct funding under the Capital Loan and Subsidy Scheme, which has up to now enabled the sector to provide new housing, but via a revenue-funded option. This means that the voluntary organisations which are ‘Approved Housing Bodies’ must seek direct finance (Direct Lending Scheme) for developments from the Housing Finance Agency (or other financial institutions). Voluntary housing bodies are also expected to rely more on long-term leasing in the private market in order to increase their stock of housing.

These changes present a considerable challenge, and risk, in the medium term. If the social housing sector in general were to be encouraged to develop its capacity through a radical enlargement (as argued below) it could indeed become more economically viable as well as less segregated.

However, there are concerns about short- and medium-term financial pressures, given the current scale of activity and the realities of the tenant rental base. For example, if a voluntary housing agency is in difficulty meeting payments on a loan, does this have as one possible consequence the abandonment or dilution of its social and moral aims – that is, the non-market reasons for existing in the first place? Could this mean, for example, that such agencies in the future may find themselves backed into a corner where the only available solution might be to sell assets or evict very vulnerable tenants in order to become more economic?

Ways Forward: A Unified Housing System?

The considerable social vulnerabilities in housing highlighted in this article derive in part from wider problems in the structure of the Irish housing system. In particular, it has developed over recent decades a very entrenched divided or ‘dualist’ rental system.21 This tendency is arguably reinforced by the realignment in social housing in Ireland which has now been taking place for well over a decade.

A ‘dualist’ or divided housing system means there is a sharp disjuncture between the market and non-market elements, with the latter being maintained only for the most marginalised households.

In a unitary housing system, by contrast, a ‘social market’ is encouraged, wherein both profit and non-profit provision meets general needs. The social housing sectors within such a system are allowed to develop greater capacity and become more economic by developing a larger tenant base and by having the benefit of rent pooling across a mature stock. While initial investment outlays are large, the rental returns and capital gains on a mature, well-maintained stock over its lifetime help to make it economic in the long run. This also has the benefit of reducing stigmatisation of particular tenures (and the unjust privileging of others) and achieving social integration within tenures as a social housing community can more easily include a mix of people – for example, in work, retired, out of work, in school or college.

In Ireland, from the 1970s onwards, and in particular during the boom years, there was a pronounced tendency towards a dualist system. In the aftermath of the boom, we see a continuation of the trend towards more and more public resources being diverted to quite costly market mechanisms to meet social need, while non-market investment and experimentation is reduced. In the current climate, it seems even less likely that a radical realignment towards a unified model can occur.

At the very least, a number of issues explored in this article suggest we should give serious consideration to alternatives to the current trends in Irish housing. The limits of commodification are immediately evident from the experiences of the boom–bust years. The vulnerabilities that many people experience today highlight the continuing failures of the system, particularly at the margins represented by homelessness, unmet housing need and poor housing conditions. The consequences for large numbers of individuals and families and for society as a whole of the ‘divided’ approach – which privileges private ownership and commodity investment, marginalises social provision and ignores the central values of housing as a home – highlight why this needs to be replaced by a more ‘unified’philosophy and model.

Notes

1. Department of the Environment, Community and Local Government, Housing Policy Statement, Dublin, 16 June 2011.(Available from: www.environ.ie)

2. Jesuit Centre for Faith and Justice, The Irish Housing System: Vision, Values, Reality, Dublin: Jesuit Centre for Faith and Justice, 2009, p. 9.

3. Central Bank, Money and Banking Statistics: September 2011, Table A.1, Information Release, 28 October 2011; Residential Mortgage Arrears, Restructures and Repossessions Statistics, 18 November 2011. (Available from: www.centralbank.ie)

4. The RAS scheme is targeted at people who have been receiving Supplementary Welfare Allowance (SWA) rent supplements for more than eighteen months. The fact that households in the RAS scheme are no longer considered to be in ‘housing need’ is important insofar as one apparent consequence is that people who are moved into this system may never qualify for housing provided by a local authority or a voluntary housing organisation, which for many would be the preferred long-term solution to their housing requirements.

5. Housing Agency, Housing Needs Assessment 2011, Dublin: Housing Agency, 2011.(Available from www.environ.ie)

6. Tenants First, The Real Guide to Regeneration for Communities, Dublin: Tenants First and Public Communications Company, 2006.

7. Article 11 (1) of the Covenant speaks of ‘the right of everyone to an adequate standard of living … including adequate food, clothing and housing …’. The UN Committee on Economic, Social and Cultural Rights has elaborated on the implications of Article 11 (1) in its General Comment, No. 4, The Right to Adequate Housing (1991).

8. Fr Peter McVerry, Letter to Editor, The Irish Times, Tuesday, 6 September 2011; see also: Kitty Holland, ‘Council providing sleeping bags for homeless as crisis service “disrupted”, The Irish Times, Wednesday, 7 September 2011.

9. Alice Leahy, Letter to Editor, The Irish Times, Saturday, 10 September 2011; see also: Carl O’Brien, ‘Trust us – this is our reality’, The Irish Times, Tuesday, 13 September 2011.

10. Data on SWA from: Department of Social Protection, Statistical Information on Social Welfare Services 2010, Dublin, 2011. (Available from: www.welfare.ie)

11. Department of Environment, Community and Local Government, ‘Latest House Building and Private Rented Statistics’. (Available from: www.environ.ie)

12. Centre for Housing Research, Promoting Improved Standards in the Private Rented Sector: Review of Policy and Practice, Dublin: CHR, 2007, p. 64.

13. Daft.ie, The Daft.ie Rental Report, Q3, 2011. (Available from: www.daft.ie/report/)

14. Central Statistics Office, Census of Population 2011: Preliminary Results, p. 18 and Table 7, p. 33. (Available from: www.cso.ie/en/census)

15. Housing Agency, Housing Needs Assessment 2011, Table A1, p. 4.

16. Government of Ireland, 2011 Estimates for Public Services and Summary Public Capital Programme, Vote No. 25: Environment, Heritage and Local Government.

17. Mixing tenures is no guarantee of achieving social mix. There is now considerable tenure mix in the inner city of Dublin, but does it amount to social mix or integration in any positive or meaningful sense? On the other hand, many single-tenure housing developments may, in fact, achieve very complex and stable patterns of social variation organically. Some mature local authority developments have attained just this, as have some owner-occupied areas. Of course, the commitment to tenure mix would be more convincing if it were pursued with as much enthusiasm in the vast single-tenure, middle-class housing estates of all the main cities and towns.

18. Department of the Environment, Community and Local Government, Annual Report and Annual Output Statement, 2010, Dublin: Department of Environment, Community and Local Government, 2011, p. 57 (Available from: www.environ.ie)

19. Social Housing: Newsletter of the Irish Council for Social Housing, Spring 2011.

20. 2011 Estimates for Public Services and Summary Public Capital Programme, op.cit.

21. The distinction between ‘dualist’ and ‘unitary’ housing system was originally identified in: Jim Kemeney, From Public Housing to the Social Market: Rental Policy Strategies in a Comparative Perspective, London: Routledge, 1995.

Dr Michael Punch is a lecturer in the School of Sociology, University College Dublin.