Jubilee Caribbean (JCaribbean) is a newly formed non-governmental organisation, born out of the bigger Jubilee Campaigns from the turn of the millennium – Drop the Debt, Jubilee 2000 and Jubilee Debt Campaign – based in Grenada, but hoping to reach out to the wider English-speaking Caribbean islands. Due to our debt situation here, in the Caribbean, the ecumenical body that is the Conference of Churches in Grenada (CCG) saw the need to get in touch with these bigger networks and start our own particular Jubilee movement. JCaribbean’s mission is to to protect poor and vulnerable persons from the injustice of sovereign over-indebtedness and effectuate changes leading to smarter efforts to counter the effects of climate change on Small Island Developing States (SIDS). For this mission to be carried out, JCaribbean has outlined a number of activities and initiatives to be undertaken. Presently, the organisation is made up of eight religious bodies here in Grenada and have made contacts with other organisations throughout the region, mainly the Catholic church in Barbados and Dominica and the Council of Churches in Barbados, which is an umbrella organization with eleven members. The network is continuously widening and we are certain that the network will soon include contacts and organizations based on each island in our focus group.

In this article, we will explore the relationship between debt and climate change, focusing on how debt and sovereign borrowings are influenced by the consequences of climate change in the Caribbean region. We are now certain that extreme weather events are not only exacerbated, but directly caused by climate breakdown. It is a foundational axiom of climate justice that those who have contributed the least to the problem will suffer the most. This is the case for the islands of the Caribbean. Many of these nations are struggling with heavy debt burdens and are at risk of being devastated by increasingly potent storms. One main goal of JCaribbean’s is to ensure that the islands all get a “hurricane clause” included in their bilateral and multilateral loan agreements. This clause, once implemented, will automatically activate a moratorium in the event of a natural disaster which causes destruction above a predetermined value. Such a policy would be a relatively small allowance that would have a decidedly large impact on the ability of these societies to literally weather the storm that climate breakdown is bringing.

Debt and Storms

Most of the islands which make up the Caribbean Community (CARICOM) are heavily indebted. Debt is considered sustainable or unsustainable depending on the ratio of internal to external debt, in relation to the GDP of each country. Both the IMF and Eastern Caribbean Central Bank agree that debt is considered “sustainable” once it remains below the 0.60:1 (60%) debt-to-GDP ratio. So far, only two countries in the English-speaking Eastern Caribbean have managed to achieve this accomplishment – St. Kitts & Nevis and Trinidad & Tobago. Grenada is close to that target with a ratio of 63.5% as of the middle of 2018 , according to latest reports, and was projected to be even lower by mid-2019. Barbados, on the other hand is in the middle of financial restructuring after a period of exorbitant sovereign debt, reaching a high of 157.1% debt to GDP ratio in 2018, falling within 125% in 2019.

The IMF recognizes that the Caribbean’s “small island states are found to have an especially high frequency of natural disasters” and that “they are becoming much more common.” During the 2017 hurricane season, Hurricane Maria devastated Dominica and Barbuda was nearly completely wiped out. Residents had to evacuate to mainland Antigua, after Hurricane Irma. Antigua & Barbuda had a debt due to the IMF, the day after Hurricane Irma hit, but the payment was not called off or extended and the island had to pay off its tab. The payment owed to the IMF by Antigua & Barbuda was USD$2 million, a sharp contrast to the USD$152 million in damages caused as a result of the hurricane. Many persons, including Catholic Bishop Gabriel Malzaire, appealed for a moratorium on behalf of Barbuda. They were unsuccessful.

The damage caused by natural disasters can generate debts multiple times greater than the Gross National Income of a country. The harm of injury, death, and homelessness are joined by costly impacts on infrastructure, which all have medium/long-term consequences for economic growth. The impact of these storms leads to deteriorating finances and makes it harder to both meet the needs of citizens and repay debt. This ultimately leads to a situation of debt unsustainability and worsening debt situations. It is a definitional example of a vicious circle.

This is one of the focus areas in which JCaribbean will invest much of its time and effort. It is the intention of this organisation to work along with governments in the English-speaking Caribbean so that the situation with Antigua & Barbuda does not become the norm. Directly in the aftermath of a natural disaster, countries and governments’ first responsibility should be to the citizens and helping those who need it the most; ensuring that every person has access to food, housing and clothing. When countries, which are already burdened by debt, are also forced to take out new lines of credit to meet needs after a storm or earthquake, while also making payments on previous loans, it is the most vulnerable that suffer. In the long run, this situation leads to critical debt situations and growth retardation of SIDS. Unless lenders are maliciously motivated to initiate some modern form of debt peonage, it is in their interest to facilitate legal structures that preserve the ability of Caribbean nations to grow their economies even under the threat of super-storms.

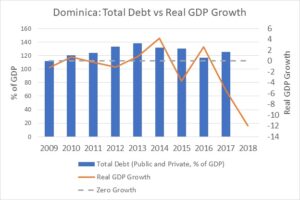

After Hurricane Maria hit Dominica in September 2017, the damage left behind amounted to approximately 225% its GDP or USD 1.3 billion. Over 90% of homes and other buildings were damaged, while the agriculture and tourism sectors were also heavily hit. In situations like these, where stronger, more intense hurricanes are battering the region, it is obvious that the islands will need to turn to debt and borrowing to keep the country running. After these disasters, a scenario which is becoming more evident is the enthusiasm of private lenders offering loans to the islands that have been damaged or destroyed. With no other timely option for securing the immediate funding necessary to meet the critical basic needs of citizens, governments usually accept these high interest loans. A look at the debt to GDP ratio of a few islands after being hit by a natural disaster shows that the figure increases in most, if not all, cases.

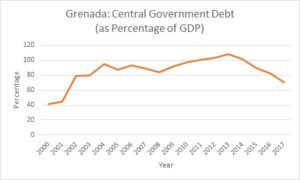

1. When Category 5 Hurricane Ivan hit Grenada in 2004, the damages were estimated at 148% of Gross Domestic Product and the debt-to-GDP ratio jumped from 79% to 94%. On its own, this is economically devastating, but the infrastructure damage had knock-on effects for the possibilities for recovery. Foreign Direct Investment went into an immediate and direct decline in the aftermath of the storm, reducing by a third.

After Ivan, Grenada was struck again in 2005 by Emily, a storm estimated to have accumulated damage worth 30% of GDP. The economy continued to struggle as debts mounted. Eventually, there was a reconstruction in 2016. As of now, Grenada has generally improved in its situation and the Debt to GDP ratio is projected to be at 58.7% at year’s-end and continuously decreasing. This was achieved through a homegrown financial restructuring programme, which included austerity budgets.

2. Tropical Storm Erika hit Dominica in 2015, which resulted in an economic crisis of its own.. This was followed by a period of recovery where the Debt to GDP ratio dropped slightly in 2016. After Category 5 Hurricane Maria hit Dominica in 2017, the growth of external loans and borrowing, increased dramatically over 2016 figures. GDP decreased by 12% and it was estimated that it would take approximately 5 years to recover from the effects of the Hurricane. . After Hurricane Maria, combined public and private debt increased to over 125% of GDP. In the event of another natural disaster striking the island, results will be catastrophic to the economy.

Risks Associated with Hurricanes and Other Disasters

Some of the major risks associated with natural disasters in the Caribbean are loss of life and property on an individual level and loss of economic activity on a national level. As I write this, we are preparing for the first developed weather system in the Caribbean for the 2019 hurricane season. Tropical Storm Dorian is expected to make landfall as a category 1 hurricane tomorrow, in the Lesser Antilles. The main fallouts expected are landslides, flooding and loss of crops and animals.

On a national level, the main risk is a slowed or halted economy. In most of the small islands, tourism is our main export, followed by agriculture. Natural disasters, especially hurricanes, cause damage to most of the infrastructure, which support both sectors. This means that fewer tourists will come to visit and farmers will experience loss in revenue from the sale of their crops. Furthermore, foreign direct investment is at an all-time high within the region, especially with each island having its own version of a Citizenship-by-Investment programme. The number one project undertaken by these foreign investors is hotels. With recent hurricanes being larger and stronger, the damage left behind is also more evident and so this in itself is a risk that potential investors will consider when deciding on where to invest and which projects to invest in.

An International Responsibility

In his visit to Grenada earlier this year, Deputy Managing Director of the IMF, Mr. Tao Zhang spoke about the devastation he saw in Dominica, more than a year after Hurricane Maria landed. He stressed that the intensity of natural disasters across the region, as a result of climate change often lead to high debt and low growth. Mr. Zhang’s advice to the region is to implement preparation measures which will reduce the effects of natural disasters. He also suggested infrastructural improvement which could reduce the destruction to physical buildings. This will eventually lead to shorter timeframes for rebuilding, encourage economies to recover faster and generally return to business as usual in a shorter time frame. The less structural damage experienced as a result of natural disasters will also greatly reduce the amount of funding that will be needed in the form of new loans and so these preventative measures can also serve to lessen the shock on the country’s economy. In response to Zhang’s challenge and in order to develop preemptive measure to fight climate change, Grenada recently created a new ministry – the Ministry for Climate Resilience. Several other countries in the region have also implemented or plan to implement measures to better prepare for these natural disasters.

The proposed responses to the risk of climate breakdown that the IMF promote is climate resilient strategies. They are not yet discussing the essential step of debt moratoria. If debtors such as the IMF agree to postpone repayment for a country recently stuck by a natural disaster, it will go a long way to ensuring the long-term economic stability of said country’s economy. A moratorium will also give the affected countries the opportunity to focus on rebuilding and meeting the critical needs of its citizens.

Mr. Zhang and other supporters of climate resilience strategies propose that the focus should be shifted from a responsive approach to a preparedness approach. In other words, our islands in the Caribbean should be pro-active, rather than reactive. This entails changes to the building-code, the building of sea defenses, and other costly measures. This policy package additionally commits Caribbean nations to establish a financial reserve for natural disasters with a guideline to follow that will ensure debt sustainability, even in the face of such horrors. With the formation of the first Ministry of Climate Resilience in the Caribbean and other plans which will unfold soon, Grenada is currently on its way to becoming the first climate resilient city in the Caribbean. Dominica has taken the experience from Hurricane Maria in 2017 and is now taking steps to become the first entirely climate resilient country, in the world. A Climate Resilient Execution Agency for Dominica was created in the aftermath of Hurricane Maria and challenged with the task of ensuring that every rebuilding effort is up to the new codes so that there will not be a repeat of that level of destruction.

The ideal scenario for the Caribbean islands is one of debt sustainability – the point at which a country can service its debt for the foreseeable future, without compromising on its national obligations to its people. The UN Inter-Agency Task Force on Financing for Development has created a debt sustainability framework, which includes a tool that can be used to predict outcomes in certain scenarios. This “realism tool” generates outcomes, based on a mix of public and private debt levels, natural disasters, etc. This is just one example of the resources available to governments and other finance decision makers, to assist with making sustainable financial choices.

Unfortunately, an economy can be as sustainable as possible and still be negatively affected by these intensifying natural disasters. The effects of climate change, mainly rising sea water levels and increasing temperatures, increase the strength and ultimately, devastation caused by natural disasters. Hurricanes in recent times have been more frequent and unrelenting compared to previous ones. Should this trend continue, and scientists believe that it will, hurricanes of the future will be massive and wreak havoc on any landmass they touch. To Caribbean islanders, the hardest reality to live with concerning climate change is that we make the smallest contribution, have little to no carbon footprint, yet experience the worst effects of it. This situation is a very difficult one to be in, especially since the damages caused only leaves behind grief, mayhem and piling debts.

Conclusion

One of the main sentiments the people of the Caribbean continuously hear is that we are a determined people who can be trusted to pick up the pieces and rebuild after natural disasters. The time has come for more than positive sentiments. …With no end to climate change and its effects in sight, the steps taken to design new debt agreements is a step in the right direction. These new agreements around debt moratoria will undoubtedly work to protect both the citizens of the Caribbean and the lenders.

Climate change can and has been widely debated by governments around the world. What cannot be undermined, is the risks posed by the emergence of increasingly stronger storms. From the damage incurred by hurricanes in Dominica, Barbuda, and the Bahamas in 2017 and 2019, new structures must be put in place to fight and/or prevent this level of devastation across the region. Such initiatives will not only serve the people of the Caribbean, but are ultimately in the interest of the lending nations as well. Prosperity is guaranteed when everyone has a share. Governments in the Caribbean must be allowed to rearrange loan agreements and have debt moratoriums included in their term of borrowing. Larger, slower, more devastating hurricanes are becoming our new normal and it is only right that we are allowed the financial room to breathe in the aftermath. We contribute the smallest carbon footprint but suffer the most with the consequences of climate change. This situation demands real international solidarity.

Final Appeal

In March of this year, Jubilee Germany, JCaribbean’s European counterpart, launched an “Urgent Action” campaign. This campaign gives German citizens (and just recently Irish citizens, through Financial Justice Ireland) the opportunity to approach their Finance ministers through emails to demand support for any Caribbean island hit by a hurricane and experiencing damages beyond a certain level. The main aim of this initiative is to encourage the European governments to put pressure on the IMF so that this moratorium can be granted to the affected countries. To support the work of JCaribbean, you can connect with Financial Justice Ireland, who are supporting this new initiative. They are partners with the UK-based Jubilee Debt Campaign who are compiling a Loss and Damage Petition. The most developed response comes from the German jubilee movement which is gaining traction as they seek to target Gerd Müller, the Federal Minister for Development to convince him to craft and implement a special arrangement for the Caribbean. All of these efforts are intended to encourage European governments to support the Caribbean islands in securing a moratorium in the event of a catastrophe.

Author: Heron Belfon

For a pdf of this article, with footnotes, click here

(Photo: Carol Winker)