Cathal O’Connell and Joe Finnerty

Introduction

This article examines the recent experiences of the owner-occupier sector in Ireland, with reference to historic trends in home-ownership, the impact of the economic crash on the housing system and the consequences that followed, and the current and pending challenges faced by the sector. Given the links between the different sectors which comprise the Irish housing system, there will be some cross-referencing to the social housing and the private rental sectors in the course of the discussion.

Tenure Trends in Irish Housing

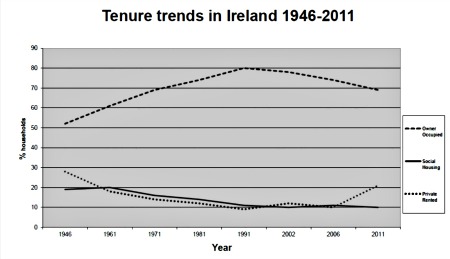

A feature of the Irish housing system has been the historically high level of owner-occupation and the consequent overshadowing of other tenures (see graph below). The rate of owner-occupation rose consistently throughout most of the twentieth century, peaking in the 1980s when the sector accounted for almost 80 per cent of the total housing stock, before a gradual reduction from the 1990s onwards.

The proportion of total housing stock represented by social housing peaked in the early 1960s at 18 per cent, reflecting large-scale slum clearance and new construction programmes in urban areas at that time. Despite extensive building during the 1970s and 1980s, this sector’s share has been in consistent decline, largely due to the impact of privatisation through tenant purchase schemes, and more recently due to the absence of large-scale new building output.1

Renting from a private landlord was once the dominant tenure in cities and towns in Ireland, with over 85 per cent of urban households in this tenure up to the 1940s. However, from then until the 1990s, there was a persistent decline in the private rented sector’s share of overall housing stock.2 This was due to the impact of social housing provision for low-income households, and the departure of middle-income private renters to home-ownership.

The prolonged period of growth in the owner-occupier sector reflected State-driven tenure strategies, employing a range of direct and indirect incentives. Moreover, the development of both private and social rental tenures was constrained by various factors which further enhanced the appeal of owning. In the case of social renting, the restriction of entry by virtue of means-testing meant that access was confined to low-income households; in the case of the private rental sector, poor quality stock, weak tenant protection, lack of security of tenure and underdeveloped governance structures relegated its appeal to a transitional option en route to either owner-occupation or social housing.

Recent Changes in Tenure Patterns

The long-term dominance of owner-occupation in Irish housing would appear to be waning. Each of the four census counts since the early 1990s has shown the level of home-ownership to have declined, and according to the Census 2011 the sector now accommodates just below 70 per cent of Irish households.3

Meanwhile, the proportion of households accommodated in the private rented sector has risen from 10 per cent to 19 per cent, while social housing has experienced a continued reduction in its overall share and now accommodates 11 per cent of households. These figures are for the country as a whole. If the data for urban and rural areas are disaggregated, an even more pronounced shift away from owner-occupation is evident as, according to the National Economic and Social Council (NESC), owner-occupation now accounts for approximately 60 per cent of housing in urban areas and private renting for almost 30 per cent.4

One of the primary drivers of the downward trend in owner-occupation has been a marked shift in housing policy, as many of the long-standing incentives and policy measures aimed at promoting owner-occupation have been phased out. These measures included first-time house buyer grants, marginal rate mortgage interest relief, preferential access to housing capital, and favourable tax treatment of private property. From the mid-1990s until their peak in 2006, rising house prices also had the effect of deterring some households from accessing the sector.

Private renting supply grew over the past two decades, initially as a result of tax incentive-based urban renewal programmes which were introduced to boost the construction sector and improve rundown areas of cities and towns.5 This had the effect of bringing on-stream large volumes of apartments, many of which were purchased by investors for letting as private rentals, using newly-developed buy-to-let mortgage products. Rental demand has been fuelled in centres of employment growth in the larger urban areas, especially among younger immigrant households working in large multinational companies.

Policy changes in relation to social housing, notably in terms of reductions in the volume of new building by local authorities and voluntary bodies, a shift towards meeting social housing need via subsidies to private landlords, and legislative reforms to enhance protections for private renters, have also contributed to changing tenure trends.6 As a consequence, more low-income households have been directed towards private renting.

The long-established and significant role of tenant purchase of local authority dwellings as an affordable route into owner-occupation is likely to diminish, as the number of properties available in this sector declines in relative terms. One consequence of reduced tenant purchase opportunities is a clear pattern of falling rates of owner-occupation among lower socio-economic households in the age groups most likely to have a mortgage (35–44 years).

Calculations by NESC indicate that between 1991 and 2011 the percentage of heads of households aged 35–44 years with a mortgage fell for all social classes but the decline was particularly severe for the skilled manual, semi-skilled, and unskilled classes, with falls from 77.1 per cent to 63.8 per cent for the semi-skilled, and from 64.9 per cent to 49 per cent for the unskilled social class.7 These were the groups most likely to be in local authority housing and to have availed of a tenant purchase scheme. The experience of these cohorts contrasts with their older counterparts whose rate of home-ownership is evidently much higher. In the long term, this change in ownership patterns raises the question of whether reduced access to owner-occupation will become an embedded feature of the Irish housing system for low-income households.8

The Irish Housing Boom

This section of the article discusses the Irish housing boom during the early to mid-2000s. At its peak, in 2006, Irish housing output reached unprecedented, and what were ultimately to prove unsustainable, levels. In that year, just over 93,400 housing units were produced, which equated to 18 units per 1,000 of population. The only other European country to build so many units was Spain (which also experienced calamitous housing and economic crashes). In contrast, the majority of EU Member States built fewer than six units per 1,000 of population.

Despite the inherent risks of over-reliance on the construction sector, the appeal of an Irish property-driven boom was hard to resist, even for the government. Construction was a major driver of employment growth, both directly and indirectly, and property-related taxes grew steadily, accounting for 7 per cent of total tax revenue in 1999 but rising to 17 per cent by 2007.

Rising property prices were also a feature of this period and house prices doubled between 2000 and 2006. The dominant political and economic narrative was that the boom-time property market would experience a ‘soft landing’ and a more sustainable growth pattern would take root.9 These predictions were very wide of the mark and the commentators warning of a collapse were ultimately proven correct.10

The Irish Economic and Housing Crash

The collapse of the Irish property market, with the price fall at its greatest estimated to have been in the region of 60 per cent from the peak in 2006,11 had calamitous consequences at societal and household level.

The economic collapse led to the loss of national economic sovereignty and the imposition of a severe and extended period of austerity prescribed as part of the EU/IMF bailout. Under the terms of the bailout, private sector debt was socialised and the accompanying economic crisis resulted in unemployment rising to almost 15 per cent at its peak in 2012 and net emigration returning to levels experienced in the 1980s.12

The economic crisis directly impacted on the functioning of the various sectors of the Irish housing system. Social housing output all but ceased as State-funded capital investment evaporated. In turn, the number of households assessed as qualifying for social housing reached a high of 98,318 in 2011, an increase of 75 per cent on the number in 2008.13 The Irish developer/construction sector disintegrated as development activity ground to a halt. The number of households ascending to owner-occupation contracted as banks imposed strict lending restrictions and households were reluctant to take on long-term debt in times of uncertainty about incomes and security of employment.

The reduced levels of housing mobility and access to both of these sectors has led to greater pressure on the private rented sector, especially as an alternative to social housing. Of the 89,872 households which qualified for social housing in the 2013 assessment of housing need, 75 per cent were living in the private rented sector, and two-thirds of these households were dependent on Rent Supplement.14

Mortgage Arrears, Repossessions and Housing Distress

For the owner-occupier sector, the housing crash had multiple consequences, ranging from negative equity to the incapacity of households to maintain their mortgage repayments. Regarding negative equity (that is, where the outstanding debt is greater than the value of the dwelling), 64 per cent of all mortgages drawn down between 2005 and 2012 relate to dwellings which are now in negative equity, with the majority of the householders affected in the 30–39 years age group. This has clear implications for household mobility and consumption patterns and reverberates beyond those directly affected, as households which are in ‘positive equity’ become more cautious and save more and spend less to compensate for reduced house values.15

Housing distress in the wake of the economic crisis was also manifested in the phenomenon of mortgage arrears, as increasing numbers of households found themselves unable to keep up with their repayments. The primary causes of these difficulties were falls in income due to unemployment and reduced working hours, cuts in wages and increases in taxes. For many households which had entered the housing market at its peak, borrowings were sustainable only on the basis of dual incomes so, when one or both earners experienced a reduction or loss in earnings, vulnerability to mortgage default was heightened.

The scale and extent of this form of housing distress is evident in the data on arrears in respect of principal dwelling houses (PDH) from the latter half of 2009 onwards. Data published by the Central Bank show that the total number of such arrears peaked at 143,851 in the quarter ended December 2012, before gradually falling to 110,366 in December 2014.16

Looking at arrears in excess of 90 days, these rose from 26,271 (3.3 per cent of PDH mortgages) in September 2009 to a peak of 99,189 (12.9 per cent) in September 2013.17 Since then, they have declined gradually, so that by December 2014 there were 78,699 accounts in arrears for more than 90 days, representing 10.4 per cent of PDH mortgages.18

While the reduction in the overall number of arrears is welcome, the reality is that it reflects mainly a decline in short-term arrears. Arrears of up to 180 days (six months) fell from 68,436 in December 2012 to 40,706 in December 2014 (with arrears of up to 90 days falling from 49,363 to 31,667, and arrears of between 91 days and 180 days falling from 19,073 to 9,039).19

The number of arrears of 181 days and over has also fallen, from a peak of 82,509 in September 2013 to 69,660 in December 2014. However, the proportion of arrears that are of over 181 days duration has increased continuously since 2012 and in December 2014 these accounted for 63 per cent of all arrears and 88 per cent of arrears over 90 days. Moreover, a growing number of PDH mortgage accounts are moving into very long term arrears – that is of 720 days (two years) and over. These arrears reached 37,778 (that is, 34 per cent of all arrears and 48 per cent of arrears over 90 days) in December 2014, which signifies a hard core of mortgages in deep difficulty with potentially ominous consequences for the households concerned.

The question which arises from this trend is whether such arrears levels are generating ‘snakes’ in the housing system as they do in other countries, as measured by key indicators such as house repossessions and rising levels of homelessness.20 In other words, employing the metaphor of the children’s board game, are vulnerable households sliding off the ladder of owner-occupation and down the snake of housing distress to repossession and homelessness?

The evidence in Ireland to date regarding house repossessions suggests that the snake has not yet fully taken hold. However, the overall trend in repossessions since 2009 is upwards. In the period from the end of September 2010 to December 2014 a cumulative total of 3,863 primary dwelling homes were repossessed by lenders; of these, 1,114 dwellings were repossessed by way of court orders and 2,749 by way of ‘voluntary surrender/abandonment’ by householders.21 It is noteworthy that around half of all these repossessions took place in 2013 and 2014.

There is, as yet, no documented evidence in regard to the impact of the increase in repossessions on the extent of homelessness in Ireland. However, in a context where there has been a rise in homelessness, including among families,22 there has to be concern that a significant rise in repossessions will lead to a worsening of the problem. Given the lack of local authority housing, people whose homes are repossessed will likely have to turn to the private rented sector. However, increases in rents over the past number of years, particularly in the larger urban areas, have meant that low-income households, and especially those dependent on Rent Supplement, are unable to afford the rents being demanded.23 Even if households whose homes have been repossessed are able to afford to enter the private rented sector, the reality is that this represents additional pressure on a sector which is already struggling to cope with demand, especially in urban areas, and this could lead to even further increases in rents, and ultimately to increases in homelessness.

Policy Levers and Safety Nets

If the conditions for a ‘snake’ are present in the Irish housing system, why has it not materialised to date in the form of mass repossessions? The explanations for this relate to market conditions and policy levers and welfare safety nets, each of which is now looked at in turn.

Market conditions since the housing crash have not been conducive to banks repossessing homes, as house prices have recovered slowly. However, with increases in house prices, evident especially in urban areas,24 it can be expected that the attitude of lenders will change as it is realised that repossessions can make inroads into arrears and yield returns on outstanding housing debt.

The public policy levers have taken the form of a ‘code of conduct’ on mortgage arrears issued by the Central Bank of Ireland25 and the establishment of a personal insolvency service.

Under the Central Bank Code of Conduct, mortgage lenders are legally bound to put in place a Mortgage Arrears Resolution Process (MARP) and establish an Arrears Support Unit.26 Compliance with the Code involves adhering to a moratorium on repossession proceedings against households which fall into arrears, so long as they are deemed to be co-operating with the resolution process. As a result, the repossession figures which have been recorded are attributable almost exclusively to foreign lenders who were not party to the State bailout, sub-prime lenders who lent money at very high interest rates to borrowers deemed to be too risky by mainstream banks, and mainstream bailed-out banks where terms of existing agreements have not been adhered to by borrowers.

Given the requirement under the Code of Conduct to put in place a MARP, financial institutions have to operate within a framework in their handling of cases and this has resulted in a greater level of engagement when repayment difficulties arise or mortgages are identified as being vulnerable to going into arrears. Most evidently this appears in the form of loan accounts which have been restructured. ‘Restructuring’ covers a variety of arrangements, including interest-only repayments, reduced instalments, loan term extensions, arrears capitalisation, payment moratoria and deferred interest arrangements.27

The number of PDH mortgage accounts which have undergone restructuring has increased significantly, rising from 79,852 at the end of December 2012 to 114,674 at the end of December 2014 (an increase of almost 44 per cent). This means that by December 2014, just over 15 per cent of all PDH mortgages were restructured accounts.28

Perhaps this is a pointer to why the number of mortgages in arrears of 90 days and under has been falling. Early identification and engagement between lender and borrower diverts potential defaulters into a ‘pre-arrears’ restructuring process. Where repayment arrears are capitalised, which is the most common form of restructuring, the mortgage is no longer classified as being in arrears so long as the borrower adheres to the agreed repayment terms.

According to Central Bank data, arrears capitalisation has been increasing both in overall terms and as a share of restructured mortgages. At the end of December 2012, the number of mortgages restructured through capitalised arrears was 9,754 (amounting to 12.2 per cent of the 79,852 mortgages which had been restructured).29 By December 2014, the number of such restructured loans had increased to 29,615 (representing 25.8 per cent of the 114,674 mortgages which had been restructured).30

The other main restructuring strategy – extending the term of the loan – accounted for 17,070 (14.9 per cent) of all restructured mortgages in the quarter to the end of December 2014.31 Therefore, arrears capitalisation and term extension accounted for 46,685 or 40.7 per cent of all mortgage restructures at the end of 2014. While these arrangements may offer the appearance of a solution it is questionable whether they will be long-term remedies in many cases, as they do not address the underlying problem of unsustainable debt.

Threat of repossession all too real for many Irish households

The other policy lever is the personal insolvency service, which was established by the Government in 2012, and allows for the implementation of personal insolvency arrangements including secured debts such as mortgages. However, the personal insolvency provisions have been criticised as dealing with low numbers (approximately 1,000 in 2014) relative to the scale of the housing and general debt problem and because of the veto on resolution proposals which they currently give to financial institutions.

The Government has now announced that it intends to introduce measures to reform the personal insolvency framework, including the introduction of legislation ‘to give Courts the power to review and, where appropriate, to approve insolvency deals that have been rejected by banks’.32

The final element of the explanation for the absence to date of repossessions on a large scale in the Irish housing system relates to the role of social policy safety nets in supporting vulnerable households. The most relevant is the Mortgage Interest Supplement. This provision was introduced in the 1980s by the Department of Social Welfare (now the Department of Social Protection) for the purpose of offering temporary support to borrowers who needed assistance to meet the interest element of mortgage repayments.

During the crash, the take-up of Mortgage Interest Supplement expanded significantly as more home-owners encountered difficulties in meeting their repayments. The number of people receiving the payment increased almost four-fold between 2007 and 2009 (rising from 3,712 to 14,716) and then increased further to reach 18,703 in 2011. Expenditure rose from €11.6 million in 2007 to €67.8 million in 2011.33

The report of the Inter-Departmental Mortgage Arrears Working Group (the Keane Report) in September 2011 recommended that receipt of Mortgage Interest Supplement should be time-limited, arguing that paying it indefinitely was not an appropriate or a sustainable solution to mortgage arrears.34 Changes to eligibility criteria (namely, a requirement to engage in a Mortgage Arrears Resolution Process, agree a payment arrangement with the lender and comply with this for a period of not less than 12 months) were introduced in June 2012.

As a result, the number of people receiving the payment fell to 14,437 in 2012 and to 9,768 in 2013; expenditure fell to €55 million in 2012 and then to €35 million in 2013. From the beginning of January 2014, the scheme has been closed to new entrants and it is to be phased out over a four-year period, to end in 2018. By March 2014, just 8,900 people were receiving Mortgage Interest Supplement, and the allocation for the scheme for 2014 was €17.9 million.35

A ‘Tidal Wave’ of Repossessions?

One question which arises is: what will happen if and when the attitude of lenders becomes more aggressive towards borrowers in arrears? In March 2013, the Central Bank began setting Mortgage Arrears Resolution Targets, which banks are required to meet on a quarterly basis. For Quarter 3 and Quarter 4 of 2014, the target was for banks to propose sustainable solutions to 85 per cent of customers who were over 90 days in arrears and for concluded solutions to be reached in 45 per cent of cases by the end of the year.36

These are widely interpreted as spurring the banks into pursuing borrowers more actively through the courts and by means of other types of engagement. To streamline this process, the revised Code of Conduct on Mortgage Arrears issued by the Central Bank in 2013 gave greater powers to banks, including removing the previous limit of three contacts per month from banks to customers in arrears, and changed the previous twelve-month moratorium on legal proceedings so that these may now begin either three months after the arrears process (MARP) has ended, or eight months from the date the arrears first arose. Banks are also permitted to allow their officials make unsolicited visits to a borrower’s home and they are free to dictate whatever terms and policies they chose in relation to communication with borrowers.

Responding to the announcement of the Code in June 2013, FLAC (Free Legal Advice Centres) stated that the new Code seemed to be ‘a set of rules designed to allow lenders to speed up and streamline their dealings with borrowers, with the lender remaining exclusively in control of the process and the outcome’.37 The Director of FLAC observed that the introduction of these measures, coming at the same time as the passing of the Land and Conveyancing Law Reform Bill 2013, meant that ‘borrowers in arrears are under more pressure than they ever were before. By contrast, it is being made easier for lenders to repossess properties with every month that passes’.38

There is evidence that the more aggressive approach is translating into increased applications to the Circuit Court for possession orders. Since the housing crash of 2008, there has been a steady rise in these. In 2014, a total of 8,164 applications were made to the Circuit Court, the great majority of them in respect of principal dwelling houses.39

Figures for the first three months of 2015 show there was a marked increase in the number of repossession applications granted by the Circuit Court as compared to the same period a year earlier, with 586 repossession orders granted in 2015, as against 95 in the first quarter of 2014. Nearly two-thirds of the orders (383) in 2015 were in respect of principal dwelling houses.40

The scale of orders sought has put pressure on the Circuit Courts and many repossession applications are now adjudicated by County Registrars rather than judges. The Circuit Court cautions that orders for possession do not necessarily equate with actual possessions; however, if the number of applications follows the recent trend then it is almost certain that these will translate into higher repossession statistics and the Irish Mortgage Holders Association has estimated that approximately 25,000 repossessions could occur.41

Conclusion

This article has examined the long-term trends and recent experiences in the owner-occupier sector in Ireland. A number of broad conclusions can be drawn.

Firstly, there is a substantial segment of households in long-term arrears and the number of mortgages being restructured continues to rise. As the economy shows signs of recovery, native financial institutions are adopting more aggressive tactics towards households in arrears, which will be compounded with the arrival of international vulture funds. Initiatives to keep people in their homes such as the mortgage-to-rent scheme have had very low take-up and require significant reform if they are to play a meaningful role in stabilising peoples housing situation in the face of threats from lenders.42

There is no deep political appetite for writing off debt for householders as was extended to large-scale debtors by financial institutions and proposals to revise bankruptcy to one year are likely to be rebuffed. The ideology of moral hazard has been invoked as a reason against large-scale debt write downs and the underlying ethos of possessive individualism may well constrain expressions of solidarity and mobilisation among home-owners.

Secondly, in relation to emerging tenure trends, while it is notoriously difficult to forecast these (a 1989 NESC report on housing characterised the private rented sector as a ‘sunset tenure’!), it is possible that levels of owner-occupation in Ireland could return to post-war levels. This would involve the tenure, in the future, accommodating less than 60 per cent of Irish households nationally, with owner-occupation becoming a minority tenure in the main cities.

At national policy level, such a development is implicit in the pivot in Irish housing policy towards tenure neutrality (and away from privileging owner-occupation),43 while Central Bank regulations on minimum deposits announced in January 2015 will undoubtedly impact on the relative appeal of owning versus renting.44 A shrunken owner-occupied sector would also mirror tenure trends in countries such as England and the United States, and would reflect economic forces – principally, increased labour market casualisation and precarity – acting on housing systems in all advanced capitalist societies.

Notes

1. Joe Finnerty, ‘Homes for the Working Class? Irish Public House-building Cycles, 1945–2001’, Saothar, Vol. 27, pp 65– 71, at p. 65.

2. Michelle Norris and Declan Redmond (contributing editors), Housing Contemporary Ireland: Policy, Society and Shelter, Dublin: Institute of Public Administration, 2005.

3. Central Statistics Office, Census 2011 Results: Profile 4, The Roof over our Heads – Housing in Ireland, Dublin: Stationery Office, 2012, p. 12.

4. National Economic and Social Council, Homeownership and Rental: What Road is Ireland On? Dublin: NESC, 2014, Report No. 140.

5. Report of the Commission on the Private Rented Residential Sector, Dublin: Stationery Office, 2000.

6. Joe Finnerty and Cathal O’Connell, ‘Fifty Years of the Social Housing ‘Offer’ in Ireland: The Casualisation Thesis Examined’, in Lorcan Sirr (ed.), Renting in Ireland, The Social, Voluntary and Private Sectors, Dublin: Institute of Public Administration, 2014.

7 National Economic and Social Council, Homeownership and Rental: What Road is Ireland On?, op. cit., pp 14–15.

8. Ibid., p. 16.

9. Alan Barrett, Ide Kearney and Martin O’Brien, ‘Economic Commentary’, Quarterly Economic Commentary, Summer 2007, Dublin: ESRI, pp 1–39, at p. 15.

10. See for example, Morgan Kelly, ‘On the Likely Extent of Falls in Irish House Prices’, Special Article, Quarterly Economic Commentary, Summer 2007, Dublin: ESRI, pp 42–54.

11. Daft.ie, The Daft.ie House Price Report: An Analysis of Recent Trends in the Irish Residential Sales Market 2012 Q3, Dublin: Daft.ie, 2012. (http://www.daft.ie/report/Daft-House-Price-Report-Q3-2012.pdf; accessed 19 March 2015)

12. For data on unemployment, see Central Statistics Office, Quarterly National Household Survey, 2012 (Quarters 1, 2, 3), Dublin: Stationery Office, 2012. For data on emigration, see: Central Statistics Office, Population and Migration Estimates, April 2014, CSO Statistical Release, 26 August 2014.

13. Housing Agency, Summary of Social Housing Assessment 2013: Key Findings, Dublin: Housing Agency, 2013, Table A1.1, p. 7. (http://www.environ.ie/en/PublicationsDocuments/FileDownLoad,34857,en.pdf)

14. Ibid., p. 6.

15. David Duffy and Niall O’Hanlon, ‘Negative Equity in Ireland: Estimates Using Loan-Level Data’, Journal of European Real Estate Research, Vol. 7, Issue 3, 2014, pp 327–344.

16. Central Bank of Ireland, Residential Mortgage Arrears and Repossessions Statistics: Q4 2014, Statistical Release, 6 March 2015, p. 1.

17. Central Bank of Ireland, Residential Mortgage Arrears and Repossessions Statistics: Q3 2013, Information Release, 28 November 2013, p. 1.

18. Central Bank of Ireland, Residential Mortgage Arrears and Repossessions Statistics: Q4 2014, op. cit.

19. Central Bank of Ireland, Residential Mortgage Arrears and Repossessions Statistics: Q4 2012, Information Release, 7 March 2013 and Central Bank of Ireland, Residential Mortgage Arrears and Repossessions Statistics: Q4 2014, op. cit.

20. See Joe Finnerty and Cathal O’Connell ‘Housing Ladders and Snakes: An Examination of Changing Residential Tenure Trajectories in the Republic of Ireland’, in Padraic Kenna (ed.), Contemporary Housing Issues in a Globalized World, Farnham: Ashgate, 2014, pp. 251–266.

21. Central Bank of Ireland, Residential Mortgage Arrears and Repossessions Statistics, from Q3 2009 to Q4 2014.

22. See: Kitty Holland, ‘Number of homeless families in Dublin up 40% since June’, The Irish Times, 12 March 2015; Department of the Environment, Community and Local Government, ‘DECLG Data, Homeless Persons, March 2015’, FileDownLoad,41347,en (http://www.environ.ie/en/DevelopmentHousing/Housing/SpecialNeeds/HomelessPeople/)

23. Following completion of an analysis of rent limits under Rent Supplement in February 2015, the Department of Social Protection decided not to increase the scheme’s maximum rent levels, principally on the grounds of a perceived danger of adding to rental inflation. Instead, the Department has opted to continue to use a case-by-case approach to dealing with the rent affordability issues facing people who are receiving Rent Supplement; this approach is within a ‘National Framework’ for preventing tenancy loss and involves the discretionary powers statutorily granted to the Community Welfare Officers who administer Rent Supplement. In addition, an ‘Interim Tenancy Sustainment Protocol’ has been in operation in the Dublin region since June 2014 and in the Cork region since January 2015; this involves Threshold and the statutory authorities working together to intervene where tenants are facing an increase that would bring their rent above the limit for Rent Supplement. See: Department of Social Protection, Maximum Rent Limit Analysis and Findings, Report, February 2015, p. 3 and p. 33. (http://www.welfare.ie/en/downloads/Maximum%20Rent%20Limit%20Analysis%20and%20Findings%20Report%20February%202015.pdf)

24. See: Central Statistics Office, Residential Property Price Index, February 2015, CSO Statistical Release, 25 March 2015; Daft.ie, House Price Report: An Analysis of Recent Trends in the Irish Residential Sales Market, 2014 in Review, Dublin: Daft.ie, 2015. (http://www.ipav.ie/sites/default/files/daft-sale-report-q4-2014.pdf)

25. Central Bank of Ireland, Code of Conduct on Mortgage Arrears 2010, Dublin: Central Bank, 2010, and Central Bank of Ireland, Code of Conduct on Mortgage Arrears 2013, Dublin: Central Bank, 2013.

26. Central Bank of Ireland, Code of Conduct on Mortgage Arrears 2013, op. cit.

27. Central Bank of Ireland, Residential Mortgage Arrears and Repossessions Statistics: Q4 2014, op. cit., p. 3.

28. Central Bank of Ireland, Residential Mortgage Arrears, Repossessions and Restructuring Statistics: Q4 2012, op. cit., and Central Bank of Ireland, Residential Mortgage Arrears and Repossessions Statistics: Q4 2014, op. cit.,

29. Central Bank of Ireland, Residential Mortgage Arrears, Repossessions and Restructuring Statistics: Q4 2012, op. cit., Table 1, p. 5.

30. Central Bank of Ireland, Residential Mortgage Arrears and Repossessions Statistics: Q4 2014, op. cit., Table 2, p. 6.

31. Ibid.

32. Department of Justice, ‘Government Strengthens Framework to Support Mortgage Holders in Arrears’, Press Release, 13 May 2015. (http://www.justice.ie/en/JELR/Pages/PR15000138)

33. Department of Social Protection, Statistical Information on Social Welfare Services 2013, Dublin: Department of Social Protection, 2014, Table G4, p. 88. (http://www.welfare.ie/en/downloads/social-stats-ar-2013.pdf)

34. Inter-Departmental Mortgage Arrears Working Group (Chaired by Declan Keane), Report, September 2011 (http://www.finance.gov.ie/sites/default/files/mortgagearr2_0.pdf). Two earlier reports also recommended changes to the Mortgage Interest Supplement. See: Mortgage Arrears and Personal Debt Group, Final Report, November 2010 and Department of Social Protection, Review of the Mortgage Interest Supplement Scheme, Dublin: Department of Social Protection, July 2010.

35. Joan Burton TD, Minister for Social Protection, Dáil Debates, 11 March 2014, ‘Mortgage Interest Supplement Expenditure’, Written Answers, PQ 222, [11940/14].

36. Central Bank of Ireland, Mortgage Arrears Resolution Targets, Dublin: Central Bank, 13 March 2013. (http://www.centralbank.ie/press-area/press releases/documents/approach%20to%20mortage%20arrears%20resolution%20-.pdf)

37. FLAC, ‘Lenders gain more control than ever under new Code of Conduct on Mortgage Arrears’, Press Release, 27 June 2013. (http://www.flac.ie/news/2013/06/27/lenders-gain-more-control-than-ever-under-new-code/)

38. Ibid.

39. Kitty Holland, ‘Banks attempt to repossess 7,000-plus homes: Mortgage holders’ spokesman warns that repossessions will reach 25,000 this year’, The Irish Times, 9 March 2015.

40. Kitty Holland, ‘Repossession orders rise by more than 500%: Circuit Court grants 586 orders since January, compared to 95 during same period in 2014’, The Irish Times, 5 May 2015.

41. Ibid.

42. Áine McMahon,‘Housing groups criticise mortgage-to-rent reforms’, The Irish Times, 14 May 2015.

43. Department of the Environment, Community and Local Government, Housing Policy Statement, June 2011. (http://www.environ.ie/en/Publications/DevelopmentandHousing/Housing/FileDownLoad,26867,en.pdf)

44. Central Bank of Ireland, Central Bank (Supervision and Enforcement) Act 2013 (Section 48) (Housing Loan Requirements) Regulations 2015. See: ‘Central Bank announces new regulations on mortgage lending’, Press Release, 27 January 2015.

Cathal O’Connell and Joe Finnerty lecture in social policy at the School of Applied Social Studies, University College Cork.